Pag-Ibig Contribution Table 2024

Are you a Filipino citizen interested in contributing to the Pag-IBIG Fund? As part of the Philippine government’s effort to promote savings, many citizens are now taking advantage of the benefits of contributing to the fund.

This blog post will provide an overview of what pag-ibig contribution is and how it can benefit you.

pag-ibig contribution table 2024

Pag-IBIG Fund (Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industria at Gobyerno) is a government-mandated savings program in the Philippines that is designed to provide housing and other benefits to its members.

The contribution rate for Pag-IBIG members is based on their monthly salary and ranges from 1% to 3% of their total compensation. Employers are also required to contribute a matching amount on behalf of their employees.

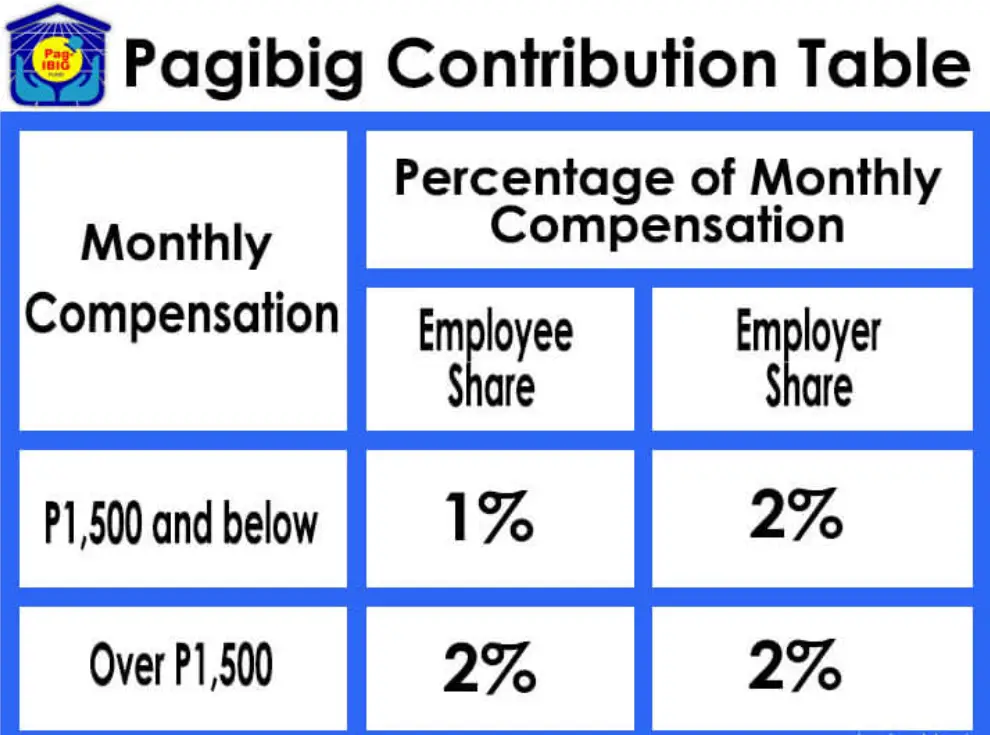

Here is an example of a Pag-IBIG contribution table:

Monthly Salary | Employee Contribution | Employer Contribution

- P1,500 and Below | 1% Employee | 2% Employer

- P1,500 to Over | 2% Employee | 2% Employer

It is important to note that the contribution table and rate can change, so it’s best to check with Pag-IBIG Fund directly for the most current information.

In addition to the mandatory contributions, members can also make additional voluntary contributions to their Pag-IBIG Fund account.

pag ibig contribution table for ofw

The contribution table for Overseas Filipino Workers (OFWs) for the Pag-IBIG Fund can vary depending on the worker’s salary. However, the contribution rate for OFWs is 2% of the worker’s basic salary, with the employer matching the contribution. The minimum monthly contribution is 200 Philippine pesos and the maximum is 1,200 Philippine pesos.

pag-ibig contribution table for voluntary members

The contribution table for voluntary members of the Pag-IBIG Fund can vary depending on the member’s salary and choice of contribution. However, the minimum monthly contribution for voluntary members is 500 Philippine pesos, while the maximum is 2,500 Philippine pesos. The member can choose to pay on a monthly, quarterly, semi-annual or annual basis.

- Use Our Tool:- Pag-IBIG Housing Loan Calculator

Alternatively, a voluntary member can opt for the “Affordable Housing Program (AHP)” where the monthly contribution will be based on the member’s gross income and loan amount. For an AHP loan, the member’s minimum monthly contribution will be 200 Philippine pesos and the maximum will be 1,200 Philippine pesos.

Calculation of Pag-IBIG Contributions

A. Step-by-step guide on calculating contributions based on the table

Calculating your Pag-IBIG contributions is a straightforward process. By following these steps, you can determine the correct amount to contribute based on the Pag-IBIG contribution table:

Step 1: Identify your monthly compensation.

- Determine your monthly salary or compensation before any deductions. This includes basic salary, allowances, and other taxable income.

Step 2: Locate the appropriate salary bracket.

- Consult the Pag-IBIG contribution table to find the salary range that corresponds to your monthly compensation. The table is typically organized into different brackets, each with a corresponding contribution rate.

Step 3: Determine the contribution rate.

- Once you have identified the salary bracket, note the corresponding contribution rate. It is usually expressed as a percentage of your monthly compensation.

Step 4: Calculate the contribution amount.

- Multiply your monthly compensation by the contribution rate obtained from the table. This will give you the exact amount you need to contribute to Pag-IBIG Fund for that specific month.

Step 5: Consider the maximum monthly compensation limit.

- Pag-IBIG contributions are subject to a maximum monthly compensation limit, beyond which contributions are no longer required. If your monthly compensation exceeds this limit, your contribution amount will be based on the maximum limit.

You can use ‘Pag-IBIG Contribution Calculator‘ for quick and precise computations.

Examples illustrating contribution calculations for different salary levels

Let’s look at a couple of examples to better understand how to calculate Pag-IBIG contributions:

Example 1: Jane earns a monthly compensation of PHP 25,000 and falls under Salary Bracket 2 in the contribution table.

- Jane’s contribution rate for Salary Bracket 2 is 2%.

- Calculating the contribution amount: Contribution amount = PHP 25,000 (monthly compensation) x 2% (contribution rate) Contribution amount = PHP 500

Therefore, Jane needs to contribute PHP 500 to Pag-IBIG Fund for that specific month.

Example 2: John has a monthly compensation of PHP 40,000, which exceeds the maximum monthly compensation limit set by Pag-IBIG.

- The maximum monthly compensation limit for Pag-IBIG contributions is PHP 5,000.

- John’s contribution rate for Salary Bracket 7 (maximum limit) is 1%.

- Calculating the contribution amount: Contribution amount = PHP 5,000 (maximum limit) x 1% (contribution rate) Contribution amount = PHP 50

Despite earning PHP 40,000, John’s contribution amount is based on the maximum monthly compensation limit of PHP 5,000. Therefore, he needs to contribute PHP 50 to Pag-IBIG Fund for that specific month.

Considerations for part-time employees, OFWs, and self-employed individuals

Part-time employees, overseas Filipino workers (OFWs), and self-employed individuals also have specific considerations when it comes to Pag-IBIG contributions:

- Part-time employees:

- Part-time employees are also required to contribute to Pag-IBIG Fund.

- Their contributions are based on their actual monthly compensation, just like regular employees.

- The same contribution table and calculation steps apply to part-time employees.

- OFWs:

- OFWs are encouraged to contribute to Pag-IBIG Fund as voluntary members.

- The contribution rates for OFWs may differ from those of regular employees.

- OFWs can choose to contribute based on their desired monthly savings or according to a specific program offered by Pag-IBIG Fund.

- Self-employed individuals:

- Self-employed individuals, such as freelancers or entrepreneurs, can also contribute to Pag-IBIG Fund on a voluntary basis.

- They need to determine their monthly compensation and refer to the appropriate contribution table.

- The calculation process remains the same, following the steps outlined earlier.

It’s important for individuals falling into these categories to understand their specific obligations and consult the official Pag-IBIG Fund website or contact their local Pag-IBIG office for further guidance and information on contribution calculations.

Remember, accurately calculating and consistently contributing to Pag-IBIG Fund will not only help you secure various benefits but also contribute to your long-term financial stability and welfare.

What is Pag-IBIG Contribution?

Pag-ibig means “love” in Tagalog, and it stands for “Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno” which translates to “mutual cooperation for tomorrow; you, bank, industry and government”.

It is a government-run program that encourages citizens to save money by providing them with access to low cost housing loans and other benefits like health insurance and remittances. The fund is managed by the Home Development Mutual Fund (HDMF) which collects contributions from its members in order to finance these programs and services.

Benefits of Contributing to Pag-IBIG Fund

The primary benefit of contributing to pag-ibig fund is that you will be eligible for a loan when you need one. The amount of loan that you can avail of depends on how much you have contributed.

The minimum loanable amount is P6,000 while the maximum amount would depend on your current contributions. Aside from housing loans, there are also other benefits such as death benefits for members who pass away due to natural causes or accidental death, vacation leave credits (VLCs), and retirement benefits for members who have reached the prescribed age limit, among others.

Remember timely contributions help in getting retirement benefits. If you want to know, what would be your monthly retirement pension, must use the ‘SSS pension calculator‘.

In addition to these financial benefits, being a member also gives you access to other services such as online application forms and eServices like Payors Portal where employers can view their employee’s contributions online and make payments accordingly. Here are some key benefits provided by Pag-IBIG Fund contributions:

-

Retirement Benefits:

- Members who have reached the age of 60 and have made at least 240 monthly contributions are eligible for retirement benefits.

- The retirement benefit is a lump sum amount equivalent to the member’s total accumulated savings, including contributions and dividends earned.

-

Housing Loans and Financing Programs:

- Pag-IBIG Fund provides affordable housing loans to its members, enabling them to acquire their own homes or finance home improvement projects.

- Members with at least 24 months of contributions are eligible for housing loans.

- The loan amount depends on the member’s actual need, capacity to pay, and the appraised value of the property.

-

Provident Savings:

- Pag-IBIG Fund serves as a savings platform for members, with their contributions accumulating as a provident fund.

- Members can earn annual dividends on their contributions, providing an opportunity for their savings to grow.

-

Short-Term Loans:

- Pag-IBIG Fund offers short-term loans to members in times of financial need.

- These loans include the Multi-Purpose Loan (MPL), Calamity Loan, and Emergency Loan, providing assistance for various purposes such as education, medical expenses, or immediate financial relief during calamities.

-

Other Programs and Services:

- Pag-IBIG Fund also provides additional programs and services to its members, including the Modified Pag-IBIG 2 (MP2) Savings Program, wherein members can save and earn higher dividends, and the Pag-IBIG Loyalty Card, offering discounts and privileges.

Retirement Benefits

Retirement benefits provided by Pag-IBIG Fund are an important consideration for members, ensuring financial security during their retirement years. Here are some key points to understand about retirement benefits:

-

Age and Contribution Requirements:

- Members are eligible for retirement benefits upon reaching the age of 60 and having completed at least 240 monthly contributions.

- For early retirement at the age of 45, members must have made at least 360 monthly contributions.

-

Lump Sum Payment:

- The retirement benefit is paid out as a lump sum, providing members with a substantial amount to support their retirement needs.

- The amount includes the member’s total accumulated savings, including contributions and dividends earned over the years.

-

Optional Modes of Payment:

- Members have the flexibility to choose the mode of receiving their retirement benefits.

- They can opt for a lump sum payment or receive it in monthly installments through the Programmed Withdrawal arrangement.

Housing Loans and Financing Programs

Pag-IBIG Fund’s housing loan programs assist members in realizing their dreams of homeownership. Here are key points to understand about housing loans:

-

Eligibility and Loan Amount:

- Members with at least 24 months of contributions are eligible for housing loans.

- The loan amount depends on the member’s actual need, capacity to pay, and the appraised value of the property.

- The loan term can extend up to 30 years, providing affordable repayment options.

-

Affordable Interest Rates:

- Pag-IBIG Fund offers competitive interest rates on housing loans, often lower than those offered by commercial banks.

- This makes homeownership more accessible and affordable for members.

-

Home Improvement Loans:

- In addition to home acquisition loans, Pag-IBIG Fund also provides loans for home improvement and renovation projects.

- Members can use these loans to enhance the value and livability of their existing homes.

Provident Savings and Short-Term Loans

Pag-IBIG Fund’s provident savings and short-term loans offer members additional financial support. Here are key points to understand about these benefits:

-

Provident Savings:

- Pag-IBIG Fund serves as a savings platform for members, with contributions accumulating as a provident fund.

- Members can earn annual dividends on their contributions, providing an opportunity for their savings to grow.

-

Short-Term Loans:

- Members facing immediate financial needs can avail themselves of short-term loans, such as the Multi-Purpose Loan (MPL), Calamity Loan, and Emergency Loan.

- These loans offer quick and accessible financial assistance, with reasonable interest rates and repayment terms.

Other Programs and Services

Pag-IBIG Fund provides additional programs and services to enhance the benefits for its members. Here are some notable offerings:

-

Modified Pag-IBIG 2 (MP2) Savings Program:

- MP2 is a voluntary savings program that allows members to save and earn higher dividends compared to the regular provident fund.

- The program provides an attractive investment option for those seeking to maximize their savings.

-

Pag-IBIG Loyalty Card:

- The Pag-IBIG Loyalty Card offers members exclusive discounts, privileges, and access to various partner establishments.

- Cardholders can enjoy savings and benefits across a range of products and services.

It’s important for members to stay updated with the latest information from Pag-IBIG Fund to take full advantage of the benefits available to them. Regular contributions not only secure these benefits but also contribute to long-term financial stability and welfare.

Conclusion

Contributing to Pag-IBIG Fund is beneficial for Filipino citizens as it provides them with access to various financial advantages such as housing loans and other social security services like retirement benefits and health insurance coverage plans.

Not only does it provide financial security but also offers convenience through its various online services available through its website or mobile app. Therefore if you want to secure your future financially then look no further than contributing towards the Pag-IBIG Fund!

Frequently Asked Questions (FAQs)

Who is required to contribute to Pag-IBIG Fund?

All employees in the Philippines, including government, private sector, and self-employed individuals, are mandated to contribute to Pag-IBIG Fund. It is also open to voluntary contributors such as OFWs and non-working spouses.

How much is the Pag-IBIG contribution?

The Pag-IBIG contribution amount depends on the member’s monthly compensation. It is determined using the Pag-IBIG contribution table, which provides the corresponding contribution rates for different salary brackets.

Can I contribute more than the required amount?

Yes, members have the option to contribute more than the required amount. This can be done as voluntary savings or through the Modified Pag-IBIG 2 (MP2) Savings Program, which offers higher dividends.

What happens if I miss a monthly contribution?

Late or missed contributions may incur penalties or result in gaps in your contribution record. It’s important to remit contributions on time to avoid any issues. If you miss a contribution, you can make it up as soon as possible to maintain a continuous contribution record.

Can I transfer my Pag-IBIG membership to another employer?

Yes, your Pag-IBIG membership is portable. If you change employers, your Pag-IBIG membership remains with you. You need to inform your new employer about your existing membership and provide the necessary documents for updating your records.

Clarification of misconceptions or common misunderstandings

Here are some common misconceptions or misunderstandings related to Pag-IBIG Fund contributions, along with clarifications:

Pag-IBIG Fund and SSS (Social Security System) contributions are the same, right?

No, Pag-IBIG Fund and SSS are separate government agencies with different purposes. While both involve contributions for social security benefits, they have distinct programs, contribution tables, and benefits. Moreover, each has its own contribution requirements and benefits structure. You can check this SSS contribution table for the latest rates.

Do I need to pay my Pag-IBIG contributions directly to the Pag-IBIG office?

No, in most cases, your Pag-IBIG contributions are deducted directly from your salary by your employer. Employers are responsible for remitting these contributions to the Pag-IBIG Fund on your behalf. It’s important to check your payslips to ensure that your contributions are being deducted correctly.

Can I withdraw my Pag-IBIG contributions anytime?

While Pag-IBIG Fund allows withdrawals under certain circumstances such as retirement, disability, or separation from service, it is primarily a long-term savings and investment program. Members are encouraged to maintain their contributions to maximize the benefits upon reaching retirement age or availing of housing loans.

Can I use my Pag-IBIG contributions for purposes other than housing loans?

Yes, Pag-IBIG Fund offers various benefits and programs that extend beyond housing loans. Members can avail themselves of short-term loans, MP2 savings, and other financial assistance programs. However, housing loans remain one of the primary benefits of Pag-IBIG contributions.

Are Pag-IBIG contributions tax-deductible?

Yes, Pag-IBIG contributions are tax-deductible. They can be considered as allowable deductions when computing the individual’s taxable income, which can result in tax savings.

More Helpful Guide:-